SME Facts & Figures

Below are some facts and figures which assist and shape the targeted Courses that we offer and for which we are uniquely qualified and experienced to address.

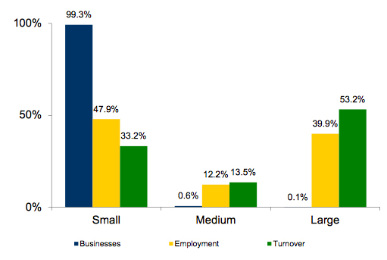

There are over 5.2 million sme businesses in the UK repesenting 99% by volume of all UK businesses

Survey results show that the Top 5 reasons for SMEs to seek advice are ...... to grow business, financial & general running of business issues, business efficiency, advice as to where to get finance and a lack of awareness of training and information sources

The main obstacles for business success are ..... the economy, competition, taxation, cashflow, obtaining finance and a lack of awareness of alternative sources of finance.

Tradtional sources for seeking advice are ..... Accountants (37%), Business Advisors (21%), Bank (8%) and Solicitor (7%) They are great in their own field but they don't always have the day-day experience and worries of a typical SME.

The main reasons for NOT applying for finance are ..... not wanting to accept additional risk, the thought that they would be rejected, thought it would be too expensive, the time taken to achieve a decision didn't know where to go for sound advice, poor credit history,

The main types of finance traditionally sought ..... bank loan (48%), bank overdraft (21%), Grant (12%), Leasing/HP (9%), Mortgage (5%)

The awareness of other alternative sources of finance is still extremely low but improving.